Spotify, Apple Music, and Amazon Music have solidified their positions as the “big three” in the U.S. paid streaming market, collectively holding more than 90% of the market share.

DMN Pro’s latest Streaming Music Subscriber Market Share database reveals this significant statistic, offering a detailed analysis of the reach of on-demand platforms in the United States. The database includes plan-specific subscriber totals derived from major music publisher statements.

Methodology and Subscriber Estimates

To provide accurate estimates of active users, DMN Pro has applied a uniform multiplier to the data from publisher statements.

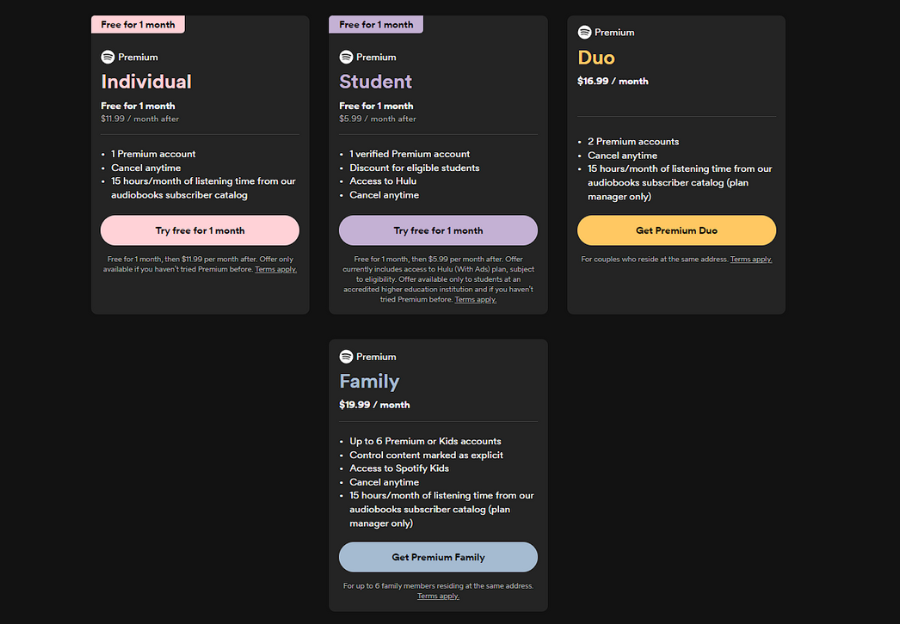

Individual accounts are counted as one subscriber each, while Spotify’s Duo plan accounts are multiplied by two to reflect two simultaneous listeners. Family accounts are multiplied by three, and Student accounts by 0.5 due to their lower monthly payments.

It’s important to note that the Mechanical Licensing Collective (MLC) uses different multipliers for calculating royalties versus market share.

Market Share Breakdown

As of February 2024, Spotify held a 36% market share, Apple Music had 30.7%, and Amazon Music accounted for 23.8%, combining for a total of 90.5% of the U.S. market.

Despite strong competition from other platforms like YouTube Music, which had a 6.8% market share, these three services dominate the landscape.

Subscriber Numbers and Market Impact

The combined market share of Spotify, Apple Music, Amazon Music, and YouTube Music amounts to an impressive 97.3% of U.S. music streaming subscribers.

YouTube Music’s 6.8% share translates to approximately 9.25 million subscribers, compared to Amazon Music’s 32.44 million, Apple Music’s 41.88 million, and Spotify’s 49.05 million.

Other services like Pandora Premium, Tidal, and SoundCloud hold smaller shares, with 2.55 million (1.9%), 721,400 (0.5%), and 460,300 (0.3%) subscribers, respectively.

Deezer, primarily focused on European markets, was not included in this analysis.

Future Market Dynamics

Several factors could influence market share shifts in the latter half of 2024. Pricing strategies and revenue contributions from different streaming packages are crucial.

While Spotify leads in overall market share, Apple Music, supported by its extensive hardware ecosystem and multi-service bundles, had over four million more Family subscribers than Spotify in the U.S. as of February.

Spotify’s recent price increases may impact its ability to close this gap.

The platform now charges more than Apple Music for most packages, including a notable $3-per-month difference for Family plans ($19.99 for Spotify vs. $16.99 for Apple Music).

Although Apple Music may also raise prices later this year, its current pricing advantage could help maintain or even expand its Family market share lead.

Why This Matters

For music producers, understanding the dominance of Spotify, Apple Music, and Amazon Music is crucial.

These platforms’ extensive reach means they are key channels for distributing and monetizing music.

The competitive landscape and pricing strategies of these services can directly impact revenue streams and audience engagement for artists and producers alike.

Staying informed about market trends and subscriber dynamics can help producers make strategic decisions about where to focus their promotional efforts and how to maximize their presence on these leading platforms.

For more insights into the global music streaming market, check out this Statista Market Forecast.

Additionally, explore how streaming platforms impact artists in this LinkedIn article and learn about the latest trends in music streaming here.

Hey, sheryll, nice breakdown. Just wondering, how’s the indie scene fairing in all this? Are smaller artists getting squeezed out?

Fascinating to see how technologies evolve and the impact they have on market dynamics. The competition between streaming services is intense.

True, but nothing beats the charm of vinyl records.

I’m not convinced Spotify’s dominance is good for most musicians. The revenue split isn’t great for smaller artists.

Your market share figures are enlightening. However, considering the fast pace of the tech industry, do you have an updated projection for 2025?

So, we’re supposed to believe these streaming giants are competing fairly? Seems like a monopoly in disguise.

lol, everyone arguing about who’s best and I’m just here using my friend’s Spotify account. why even bother?

Imagine a world where Amazon doesn’t try to do everything, including music. Can’t be me.

Interesting analysis on the current state of streaming services. It really sheds light on where the industry might be heading.

This article is gold for anyone in the music business. Understanding these trends is key to navigating the future.

Great, more trends. Because that’s exactly what music needs.